Running a business from the comfort of your home has become increasingly popular, especially in today’s digital age. Whether you’re a freelancer, consultant, or small business owner, the Business Use of Home deduction (Form 8829) can offer substantial tax benefits. Here we will explore the facts surrounding the Business Use of Home deduction and guide you on how to maximize deductions while maintaining compliance with the Internal Revenue Service (IRS).

Understanding Form 8829

Form 8829, officially known as the “Expenses for Business Use of Your Home,” is an IRS form designed for taxpayers who use a portion of their home for business purposes. This form allows you to deduct a portion of your home-related expenses from your business income, potentially reducing your overall taxable income.

Eligibility Criteria

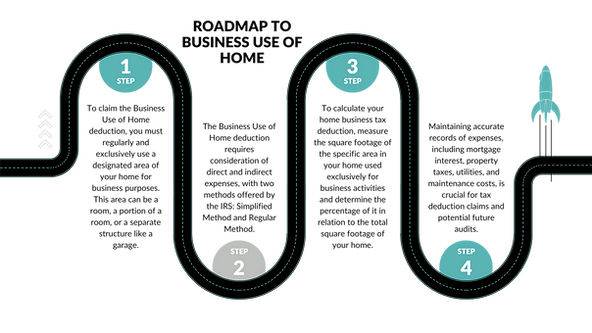

To qualify for the Business Use of Home deduction, you must use a specific area of your home regularly and exclusively for your business. This space can be a room, a portion of a room, or even a separate structure like a garage or studio.

Method of Calculation

The deduction is calculated based on the percentage of your home used for business. This includes both direct and indirect expenses such as mortgage interest, property taxes, utilities, and home insurance. The IRS provides two methods for calculating the deduction: the Simplified Method and the Regular Method.

Simplified Method vs. Regular Method

Simplified Method: This involves multiplying the square footage of your business space (up to 300 SQFT) by the 2023 prescribed rate of $5/SQFT. This method is straightforward and requires less record-keeping.

Regular Method: This method involves determining the actual expenses associated with your home office, such as mortgage interest, property taxes, utilities, and maintenance costs.

Record-Keeping

Accurate record-keeping is crucial when claiming the Business Use of Home deduction. Maintain records of home-related expenses, utility bills, and any improvements made to the business space. This documentation will be essential in case of an IRS audit.

How to Get the Deductions:

1. Identify Your Business Space

Determine the specific area of your home used exclusively for your business activities. This could be a home office, workshop, or any other space where you conduct business.

2. Calculate Business Use Percentage

Measure the square footage of your business space in relation to the total square footage of your home. This percentage will be used to calculate your deduction.

3. Choose Your Calculation Method

Decide whether to use the Simplified Method or the Regular Method. Consider factors such as simplicity, accuracy, and the potential for a larger deduction.

4. Keep Detailed Records

Maintain detailed records of all relevant expenses, including mortgage interest, property taxes, utilities, and maintenance costs. These records will support your deduction claims in case of an audit.

Reaping the Rewards

The Business Use of Home Deduction can be a valuable tool for reducing your tax liability as a home-based business owner. By understanding the facts surrounding this deduction and following the proper steps to claim it, you can unlock significant tax benefits while ensuring compliance with IRS regulations. Take advantage of the opportunities available to you and maximize the financial advantages of operating your business from home.

Disclaimer: The images featured in this blog are AI-generated and not actual photographs. We do not claim ownership of any AI-generated photos, They are presented here for illustrative purposes only.